TLDR: WATCH THE VIDEO (click above)

I recently posted a teardown that said my dad’s insurance company paid $123K for a hospital stay. That was 100% false, despite them telling me very clearly that they paid that amount.

Thanks Cassandra Bahre—an expert who wrote in—and a recent front-page NYT article) for explaining this plot twist and why the $123k is a made-up number.

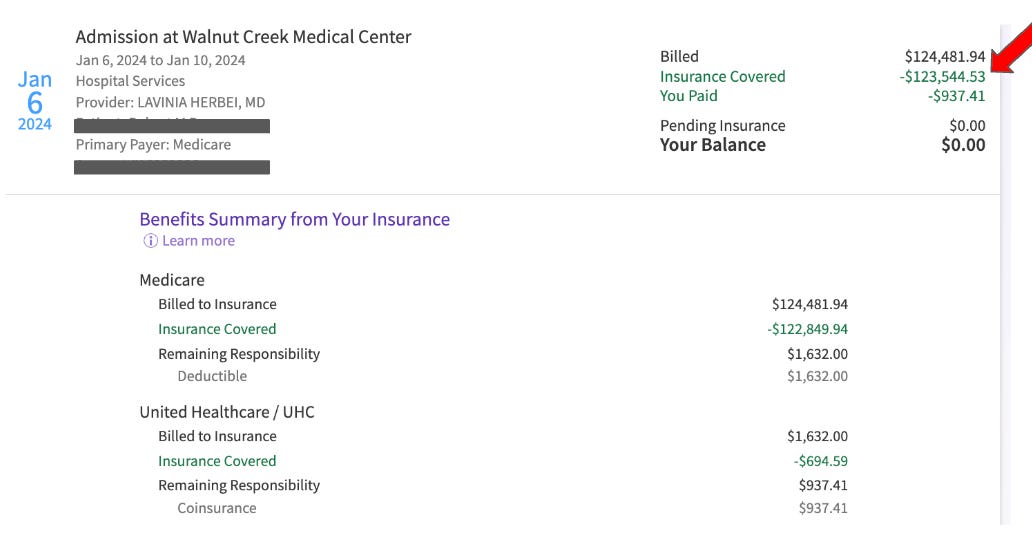

Let’s start. Here is what I saw in Epic’s MyChart -- Medicare paid ~123k!

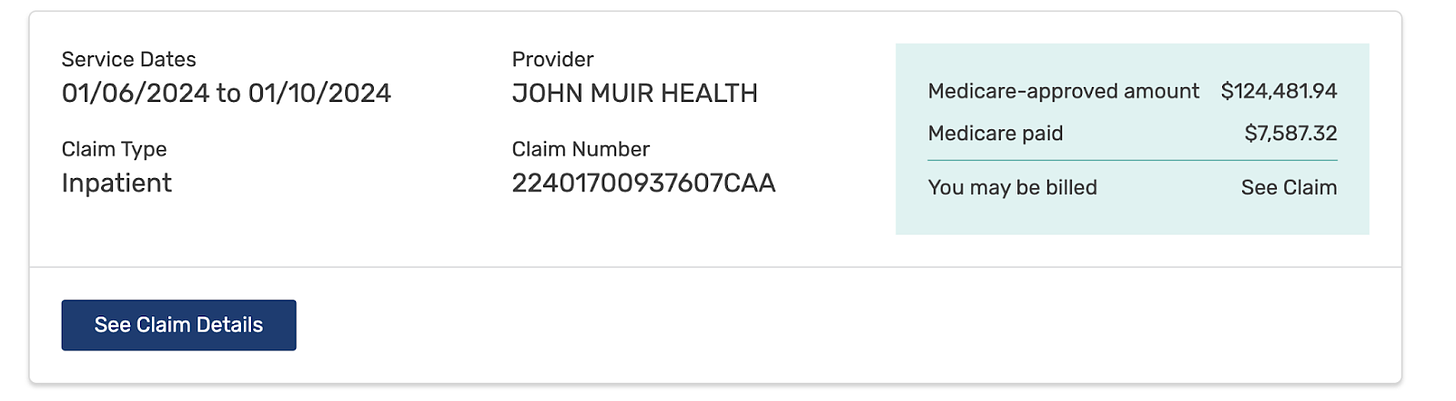

But when logging into my dad’s medicare account, it seems they actually paid 7,587.32

Um, what? What’s going on?

But here’s where Cassandra introduces the plot twist that surprised me.

Your doctor/hospital needs to manage all this complexity. It’s a lot of numbers and they can’t risk billing an incorrect amount to your insurance company (and potentially losing money). They also can’t risk being strong-armed by the insurance agency to skimp on their payments (most of these practices are small businesses too!) So what do they do?

They create a charge description master (CDM). This is a list with every medical service (CPT) and the price. What’s the price? Well, to avoid errors and lower payments, they set the fee to be higher than the highest contracted rate. And then that number becomes your Retail rate.

What does this mean for you? It means your hospital and doctors make up numbers and charge the insurance company. The insurance company then says (given they have a negotiated rate)—cool, we’ll pay the thing we said we would, not your random number. If they don’t have a negotiated rate, then it’s the insurance company and third-party vendors who just make up a number they want to pay (the NYT argues yes, it’s just made up!)

Wow. So our bills are just made-up numbers—”funny money” that’s being written off as soon as it’s billed (unless, of course, it’s being billed directly to you).

And interestingly, this time, props to the insurance companies for their framing. They turned 25% fat into 75% fat-free with a weird and clever (and horrific?) hack.

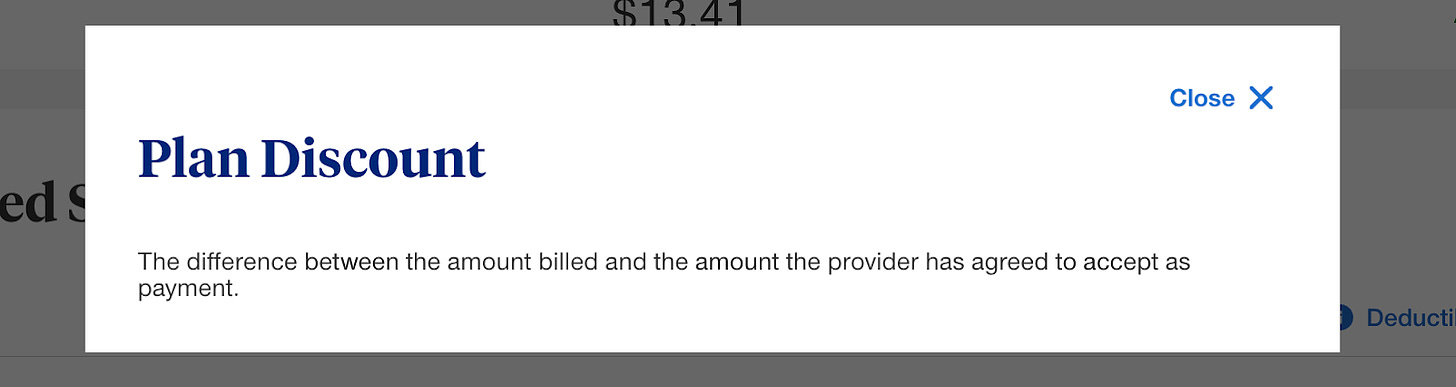

When you click to the bill, it’s re-framed as a “discount”. They need to explain to me why the doctor charged them so much money, but they’re only paying a percentage of it and getting away with it.

Instead of clarifying that the healthcare industry has zero standardization of basic pricing—driving players in the marketplace to make up numbers to charge and make up the number to pay—they call it a discount. (Apparently, a company called MultiPlan is behind this).

So at a macro level pulling back, usually I have a UX suggestion on how to fix things. But this time I’m stumped. On the face of it, this could seem like a small thing. Who cares if healthcare players do billing workarounds to get paid by insurance companies? But instead, it feels much bigger. ~15% of Americans owe medical debt. With a billing system as complicated as ours—where doctors literally make up a number and plans invent what to pay—how can normal humans negotiate payment? How can we lower payments in the US if the hospitals are just throwing out digits with extra zeros on our bills?

And of course the problem is much bigger if you’re not insured (tip: ask for cash rate and it’s lower) or paying out-of-network (it seems there is a whole different set of problems here with how insurers undercut reimbursements). 🤦♀️

So this doesn’t seem like a UX solve. It’s above the design team’s pay grade. Or maybe I’m not creative enough here to figure it out. It seems like policy folks need to step in and create standardization and transparency with pricing across providers and payers.

Oh wait, wasn’t the No Surprises Act supposed to help with transparency? Maybe not. When the No Surprises Act was announced, Multiplan said 90 percent of its revenue wouldn’t be affected.

But isn’t Medicare supposed to help with standardization? Maybe not. According to the NYT, Cigna said some out-of-network providers last year tried to charge “up to 1,904% of what they charge Medicare.” Sigh.

To circle back: yes, Medicare paid $7.6k on my dad’s behalf. And that’s nice. Thanks, Medicare. You deserve some credit. Note that my dad pays $4k in Medicare premiums annually + a $2k deductible—so just some credit, not $123k worth.

Some health teardowns you might have missed

LiveHealth: The number one problem in healthcare: LiveHealth shows us everything that’s wrong with healthcare, in one signup flow.

United Healthcare: When UX missteps meet healthcare's hidden hurdles: Healthcare UX is on the examination table–and the patient is in critical condition.

How does Calm use premium to motivate you to meditate? Calm is doing some things that work to get you to upgrade to paid… and others that don’t.

All-new teardown coming next week. See you then. 👋

Have a friend who would enjoy these teardowns? Click the button below to refer them (& earn some great rewards)👇

Questions about your product? Email kristen@irrationallabs.com.

Want to increase conversion, retention, engagement? Reach out to Irrational Labs.

We design products that change behavior, using behavioral science. Check out our case studies to see it in action.

Share this post