TLDR: WATCH THE VIDEO (click above)

As Pew and Common Cents Lab have well documented, the US faces a saving crisis. An oft-quoted statistic from the Federal Reserve in 2013 suggests that ‘42% of Americans cannot cover a $1,000 expense.’

A more recent report from the Federal Reserve suggests that ‘lowering the savings target to $400 yields a depressingly similar statistic of 40%.’

What could help? For that, we just have to look at the behavioral science playbook: defaults.

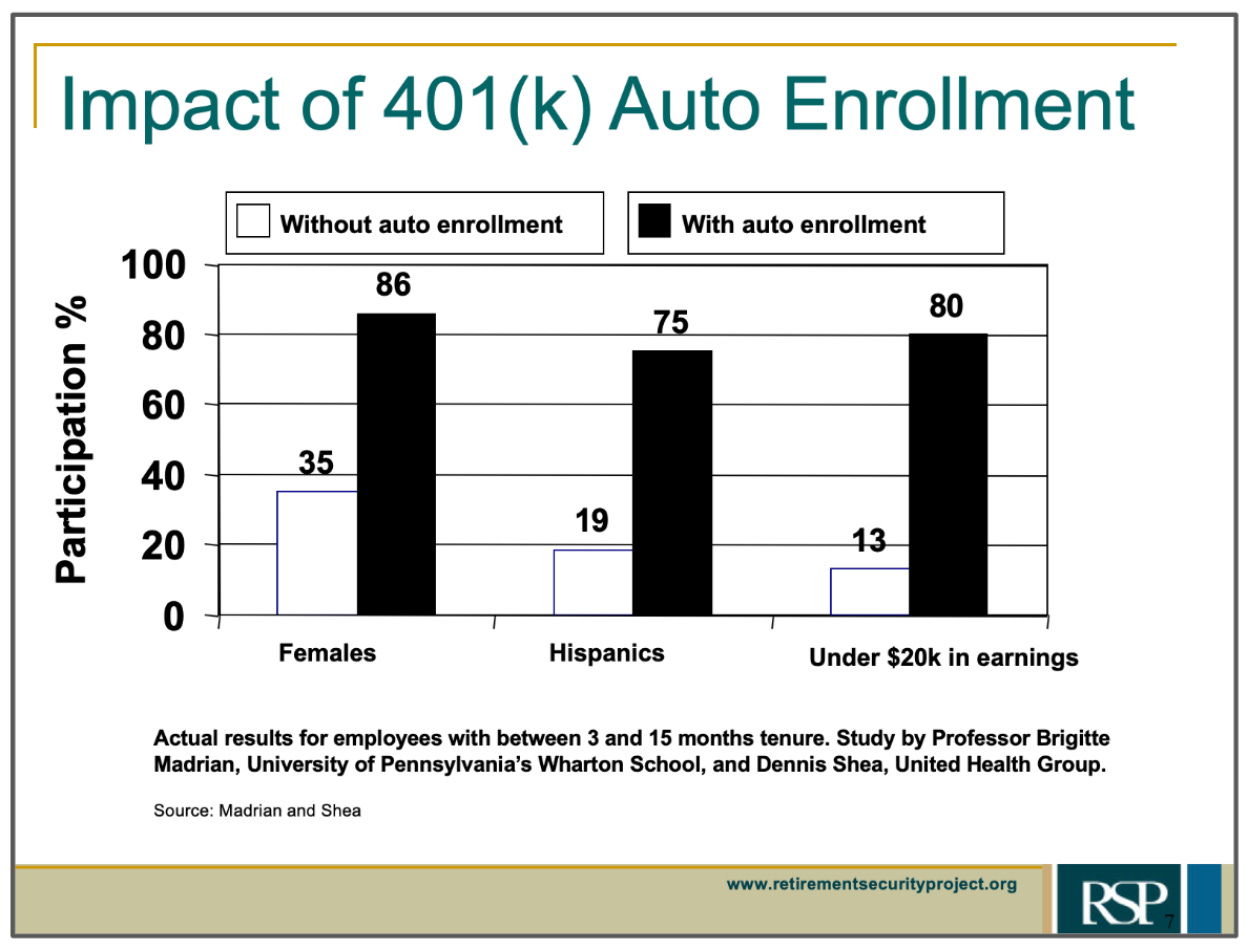

Defaulting individuals into automatic savings plans has been shown to be an extremely effective method for getting people to save for retirement. In one study, defaulting new workers into a retirement plan increased the number of employees contributing to their retirement plans from approximately 60% to well over 95%. Automatic enrollment is why we have retirement savings in America.

Surprisingly, we have yet to see this same default savings mechanism applied to short-term saving. It’s not because people don’t want it.

AARP surveyed 2,603 adults ages 25-64 and 70% said they were likely to participate in a payroll-deduction rainy day savings program if their employer offered one.

Knock knock, payroll providers—this one’s on you.

When you start a new job, you need to sign up to the payroll system. You tell the payroll provider where to send you money. What bank account do you want your $$ to be deposited into?

In a behavioral science world, what should happen? The ideal flow is to save when you get paid. Most of the money would go to your checking account, but some (2%, 3%, 5%?) would be directed into your savings account. This would happen automatically every month. Boom—America has savings.

Sadly, this does not exist.

Gusto, Rippling, and Intuit don’t make it easy to ‘save when you get paid’ during sign-up for direct deposit. In fact, all three payroll providers make it difficult, if not impossible, to add a second bank account within the direct deposit enrollment. None recommend adding your savings account, much less making it the default.

The good news: there are new kids on the block. Pinwheel and Stripe, for instance, offer services that make it easier for consumers to do deposit switching. This means I can switch my direct deposit to go into a new bank account! Hopefully, they won’t miss this massive opportunity to help consumers by offering ‘save when you get paid’ options.

3 things I cover in this teardown:

💡 What a behavioral designer would change in Payroll to increase users’ likelihood to save

💡 Why one-time decisions are an ideal way to create significant future benefits

💡 The ONE INTERVENTION I’d most like to do as a behavioral scientist

Your two cents?

What do you think of the current state of short-term savings options in payroll systems? How could they use behavioral economics to facilitate more financial well-being? Share your thoughts.

Have a friend who would enjoy these teardowns? Click the button below to refer them (& earn some great rewards)👇

Questions about your product? Email kristen@irrationallabs.com.

Intuit Payroll: Why payroll companies hold the answer to savings in America 💵